19. Receivables (CONT’D.)

(a) Trade receivables

Trade receivables are non-interest bearing and are on 30-day (2014: 30-day) credit terms. Certain palm

kernel buyers are required to make advance payment before collection of the produce. Trade receivables

are recognised at original invoice amounts which represent their fair values on initial recognition.

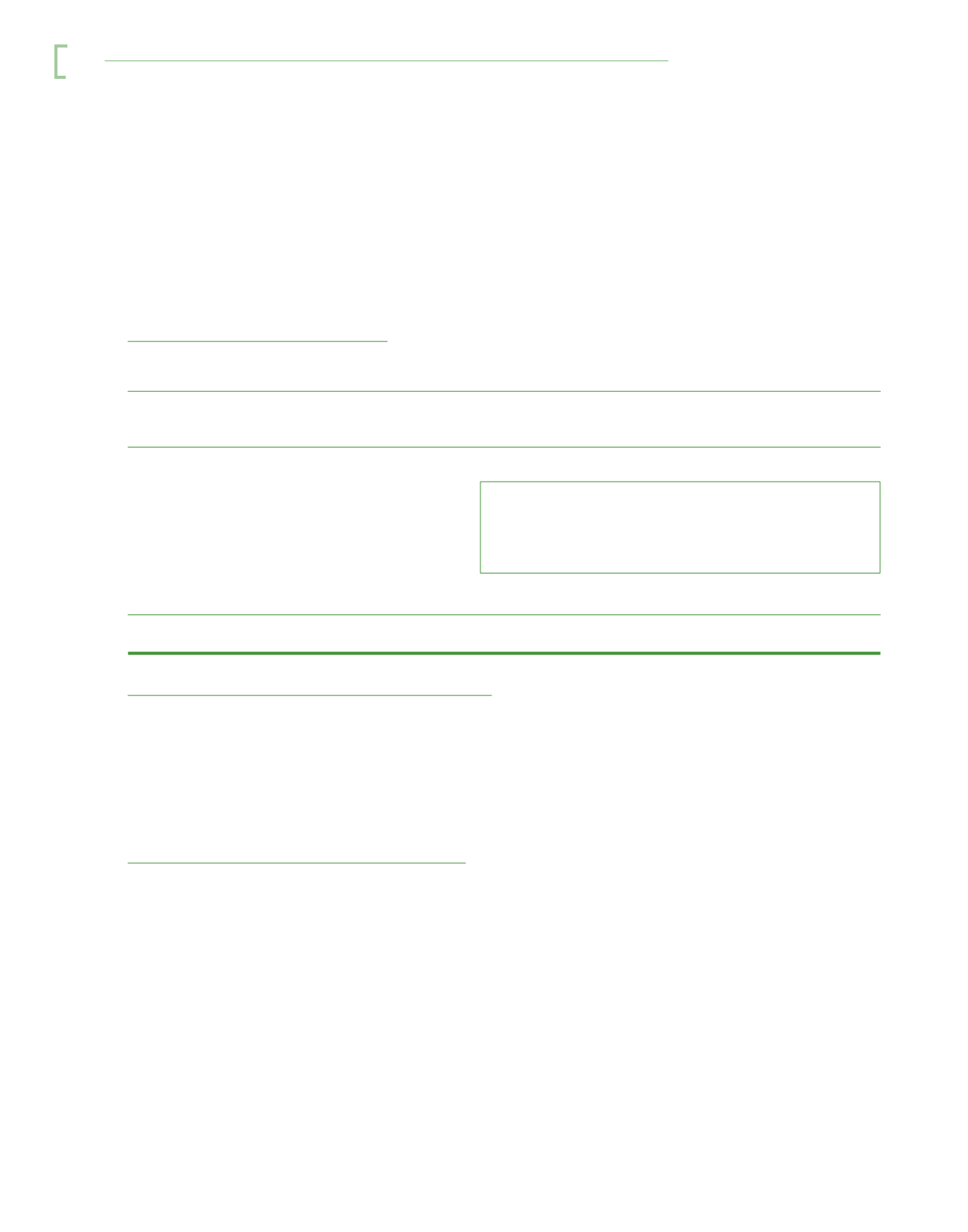

Ageing analysis of trade receivables

Group

Company

2015

2014

2015

2014

RM’000

RM’000

RM’000

RM’000

Neither past due nor impaired

36,124

36,992

-

40

Past due but not impaired:

- 1 to 30 days

488

1,728

-

-

- 31 to 60 days

113

66

-

-

- 61 to 90 days

157

119

-

-

- > 90 days

31

-

-

-

789

1,913

-

-

36,913

38,905

-

40

Receivables that are neither past due nor impaired

Trade receivables that are neither past due nor impaired are creditworthy debtors with good payment

records with the Group and the Company. These debtors are mostly long term customers with no history

of default in payments.

None of the trade receivables that are neither past due nor impaired have been renegotiated during the

year.

Receivables that are past due but not impaired

The Group’s trade receivables of RM789,000 (2014: RM1,913,000) that are past due at the reporting date

but not impaired, are unsecured. These balances relate mainly to customers who have not defaulted on

payments but are slow paymasters hence, periodically monitored.

n otes to th e f i nan c i a l statements

Bo ustead plantati o ns Berhad

10 8