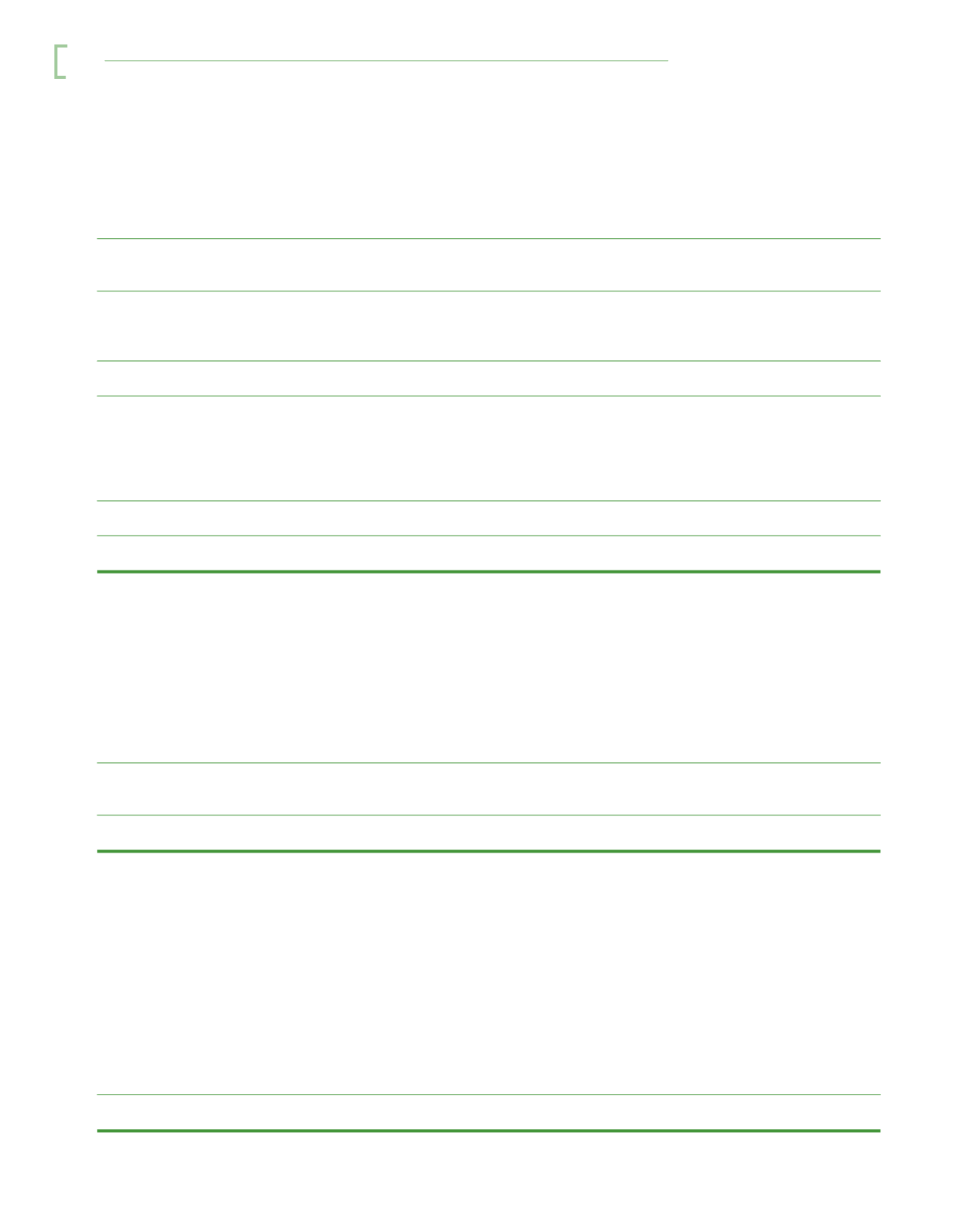

9. INCOME TAX EXPENSE

Group

Company

2015

2014

2015

2014

RM’000

RM’000

RM’000

RM’000

Malaysia income tax

- Charge for the year

22,913

39,907

14,319

25,303

- Overprovision in prior year

(766)

(787)

(739)

(948)

22,147

39,120

13,580

24,355

Deferred tax (Note 18)

- Origination and reversal of

temporary differences

(2,986)

(2,962)

(164)

(10,050)

- Underprovision in prior year

3,680

1,207

11

210

694

(1,755)

(153)

(9,840)

22,841

37,365

13,427

14,515

Malaysian income tax is calculated at the statutory tax rate of 25% (2014: 25%) of the estimated assessable

profit for the year. The domestic statutory tax rate will be reduced to 24% from the current year’s rate of 25%,

effective from year of assessment 2016. The computation of deferred tax as at 31 December 2015 has reflected

these changes.

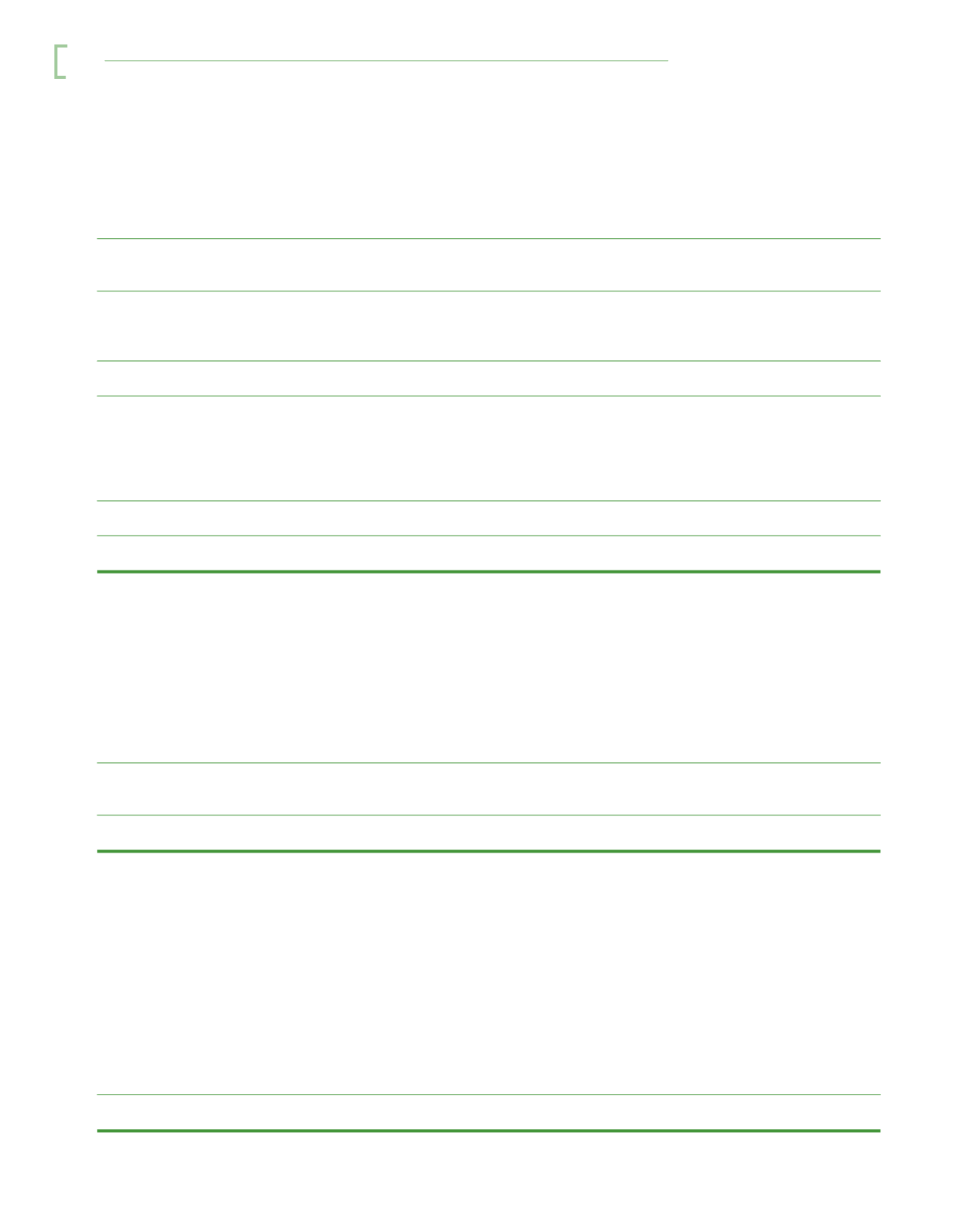

Reconciliations of the taxation applicable to profit before taxation at the statutory rate to the income tax

expense of the Group and the Company are as follows:

Group

Company

2015

2014

2015

2014

RM’000

RM’000

RM’000

RM’000

Profit before taxation

95,100

89,783

116,122

185,896

Taxation at statutory tax rate of 25% (2014: 25%)

23,775

22,446

29,031

46,474

Effects of changes in tax rates on closing

balance of deferred tax

290

486

11

(44)

Effects of share of results of Associates

(450)

(934)

-

-

Income not subject to tax

(15,616)

(765)

(21,334)

(40,353)

Expenses not deductible for tax purposes

10,357

13,034

6,447

9,176

Tax incentives

(3,215)

(2,483)

-

-

Deferred tax assets not recognised

4,786

6,090

-

-

Utilisation of previously unused tax losses and

unabsorbed capital and agricultural allowances

-

(929)

-

-

Overprovision of income tax in prior year

(766)

(787)

(739)

(948)

Underprovision of deferred tax in prior year

3,680

1,207

11

210

Income tax expense for the year

22,841

37,365

13,427

14,515

n otes to th e f i nan c i a l statements

Bo ustead plantati o ns Berhad

92