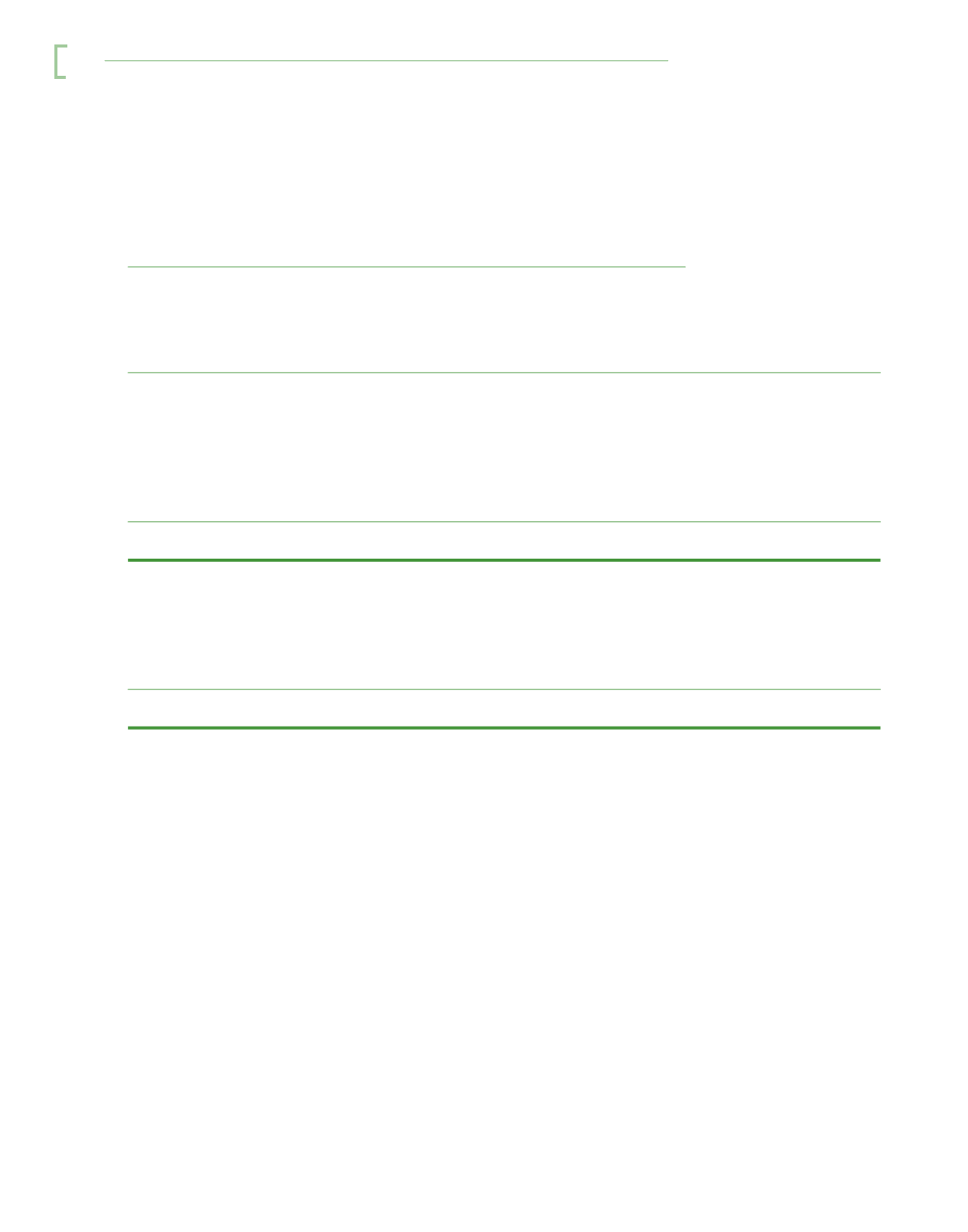

34. Financial risk management objectives and policies (cont’d.)

(ii) Liquidity risk (cont’d.)

Analysis of financial instruments by remaining contractual maturities (cont’d.)

On demand

or within

Two to

Over

one year

five years

five years

Total

RM’000

RM’000

RM’000

RM’000

Company

At 31 December 2015

Financial liabilities:

Trade and other payables

126,074

-

-

126,074

Loans and borrowings

767,285

-

-

767,285

Total undiscounted financial liabilities

893,359

-

-

893,359

At 31 December 2014

Financial liabilities:

Trade and other payables

67,379

3,500

-

70,879

Loans and borrowings

688,975

-

-

688,975

Total undiscounted financial liabilities

756,354

3,500

-

759,854

(iii) Foreign currency risk

Foreign currency risk is the risk that the fair value or future cash flows of a financial instrument will

fluctuate because of changes in foreign exchange rates.

The Group operates in Malaysia and is exposed to foreign currency risk, arising from a USD denominated

loan of USD12.7 million (2014: USD12.7 million). The loan is being closely monitored by management.

Foreign exchange exposures are kept to an acceptable level.

n otes to th e f i nan c i a l statements

Bo ustead plantati o ns Berhad

126