34. Financial risk management objectives and policies (cont’d.)

(iii) Foreign currency risk (cont’d.)

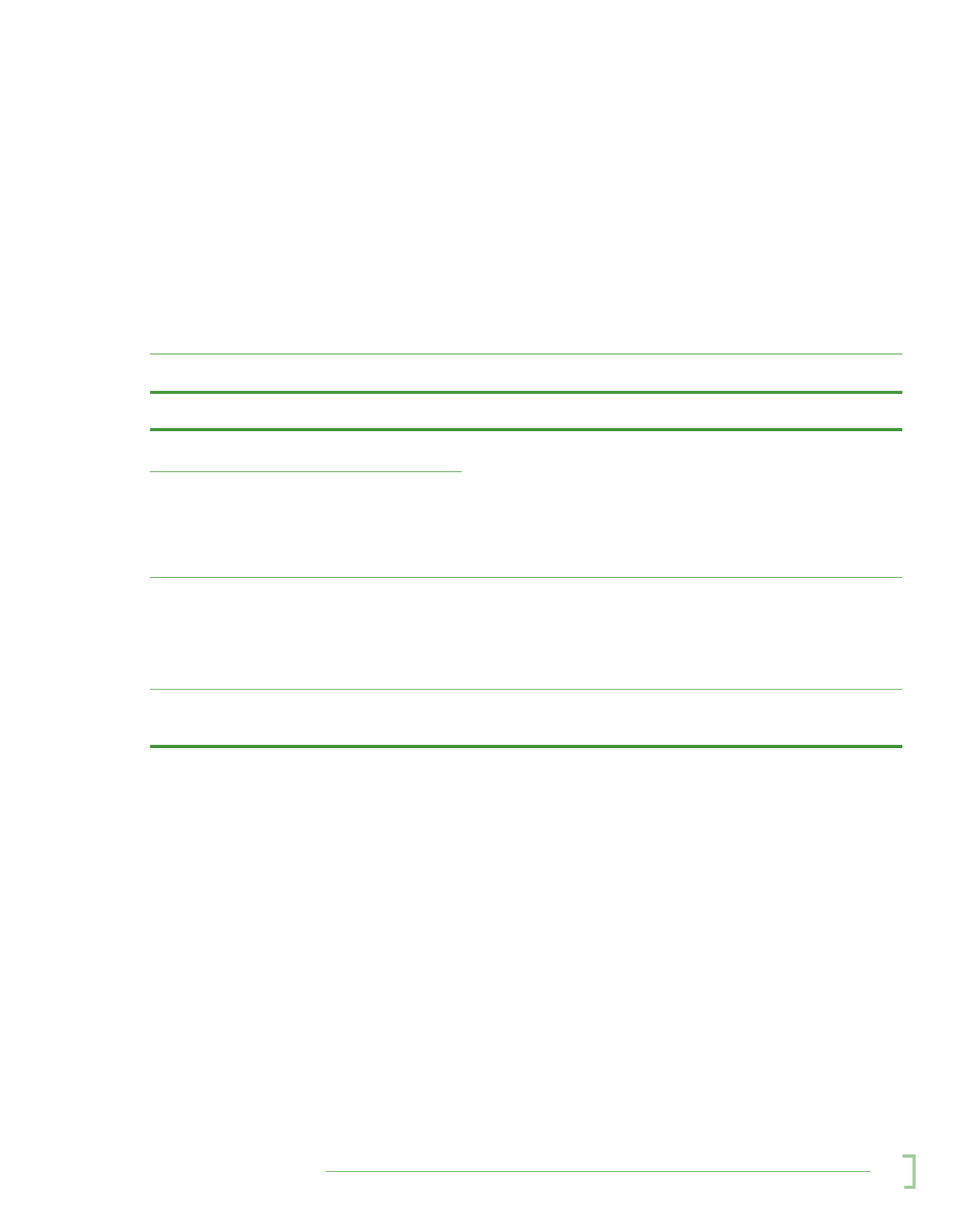

The net unhedged financial liability of the Group and Company that are not denominated in the functional

currency is as follows:

Borrowings

USD’000

RM’000

At 31 December 2015

12,700

54,508

At 31 December 2014

12,700

44,450

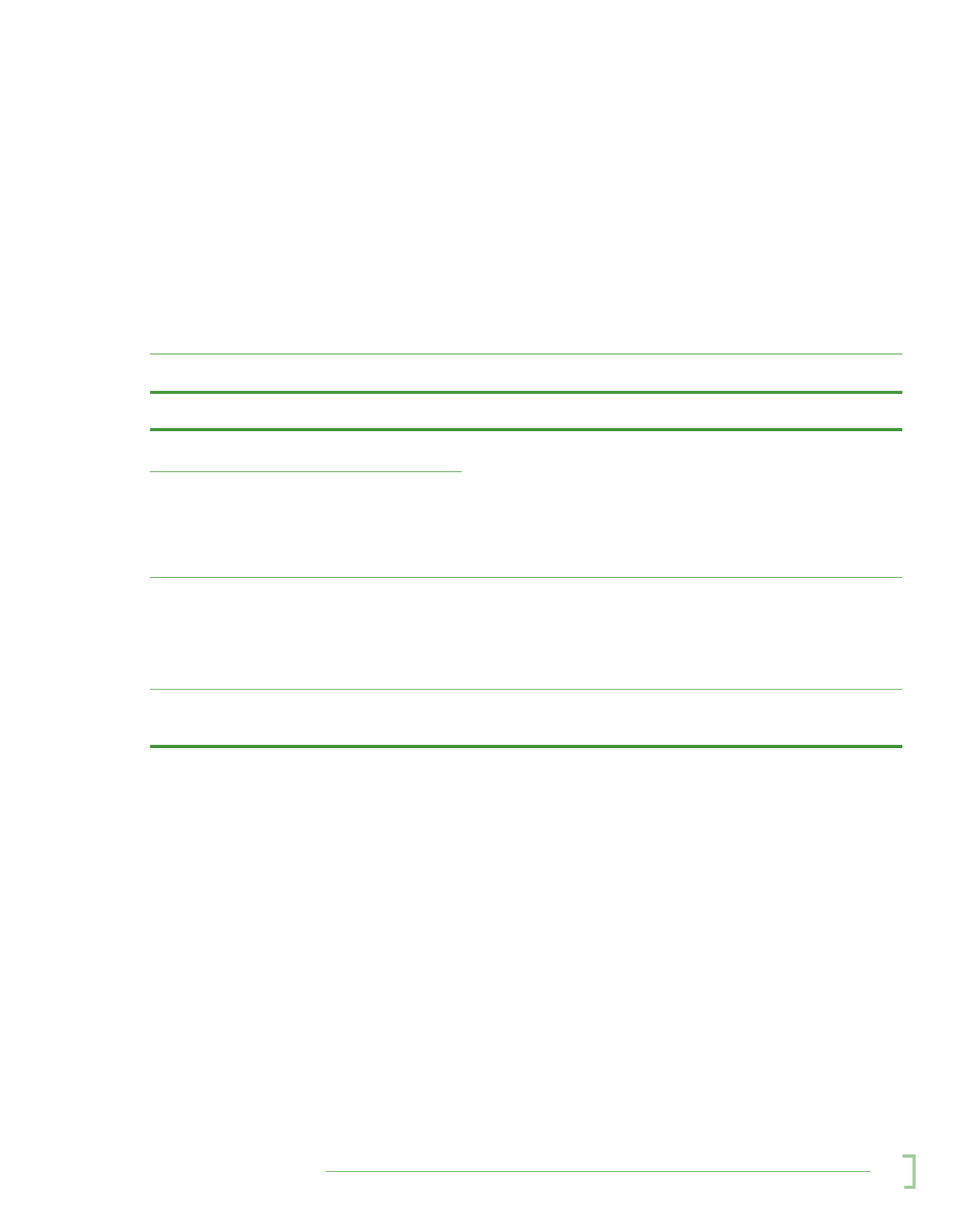

Sensitivity analysis for foreign currency risk

The following table demonstrates the sensitivity of the profit net of tax to a reasonably possible change

in USD exchange rates against the functional currency of the Group, with all other variables held

constant.

Group and Company

Effect

Effect

on profit

on profit

net of tax

net of tax

2015

2014

RM’000

RM’000

USD/RM - strengthen by 20% (2014: 10%)

(10,902)

(4,445)

- weaken by 20% (2014: 10%)

10,902

4,445

an n ual repo rt 2015

127